Acquisition project | eazeebox

A. Splitwise - Let's take a look

Conveniently under 'Alternative Dispute Resolution' as a category ;)

Seriously though, Splitwise is a fintech company. Used by all of us at some point or even regularly, Splitwise offers a comfortable way to understand expenses and split them among friends.

Let's take a deeper look at Splitwise.

Splitwise is an app that allows consumers to split expenses with friends. If a group needs to share the cost of a particular bill, Splitwise ensures that anyone who pays is reimbursed the correct amount and with minimal number of transactions (Simplify Debts 🤌🏽)

While the use cases differ, Splitwise has been the dominant product for people to split expenses between their friends/family. The US version of Splitwise has differences to the Indian version and we will focus on the Indian version for now. Let's take a look at the features of Splitwise -

- Create expenses and split them among friends/flatmates/partner

- Track payments and expenses within groups

- Simplify debts to avoid rotational payments within groups (amaze)

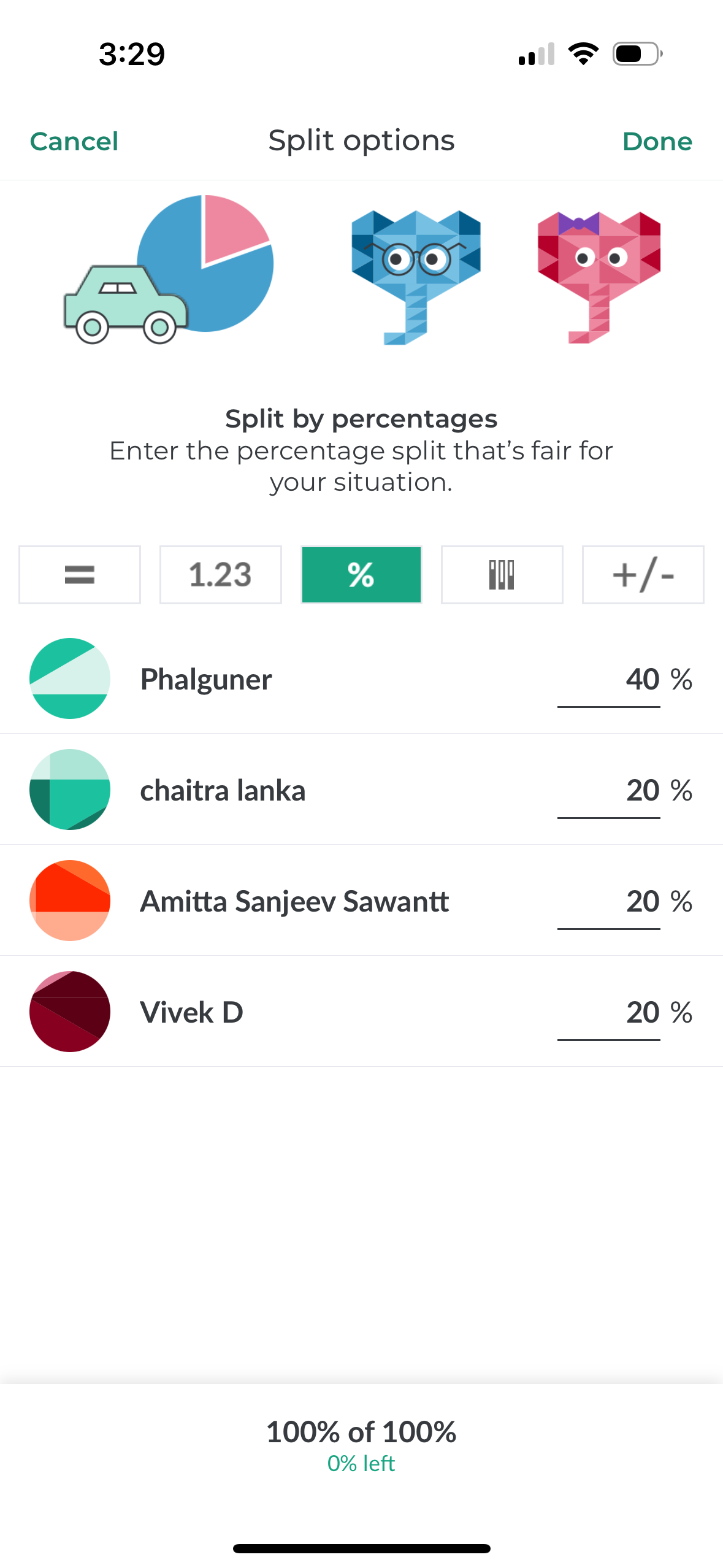

- Unequal payments and splits

- Remind people to close payments

- Export expense reports

- Charts based on category and spending over time (Pro)

- Currency based payments

- CC/DC linkage for transaction tracking and imports (Pro)

- Receipt scanning (Pro)

- Payments (Not available in India)

All in all, splitting expenses has always been a pain until we knew Splitwise. I'd say this has become a mandate in all group trips and almost everyone in the age bracket of 16-40 uses this at least a few times a year (there may be a sampling bias here). Since we've spoken about the users, lets talk a bit more -

See expense summary - who you owe and who owes you.

See Group wise expenses. You can click on any group to dive deeper.

One can add expenses within groups or just split an ad-hoc expense with some friends.

How it looks like to add an expense. This can be tagged with dates, groups, & even shared with people not on Splitwise (who get an update on email)

Expenses can be split unequally basis spending. For example, if 4 friends go to a bar and have 15 beers between them with Friend 1 having 6 beers, Friend 2 having 4 beers, Friend 3 having 3 beers, and Friend 2 having 2 beers. This can easily be split as shares split between each person.

Lastly, let me come back to one feature that stands above all - Simplify Debts.

Look at this 'Test Group' - with 4 friends.

If A owes B Rs. 100, B owes C Rs. 100, & C owes D Rs. 100 - instead of A paying B, B paying C, & C paying D (3 total transactions), A would pay D Rs. 100 directly (1 total transaction).

Makes life super simple.

B. Who uses Splitwise

One interesting fact stands out - all of the people that I interviewed (10 surveys and 7 personal conversations), who use Splitwise in different capacities, use the free version. This ranges from power users to occasional ones. I, an occasional user, also only got the paid version for a month just to understand the product better. This isn't because the app is unaffordable for people but probably because the it is simply manageable for users to watch the ads and work with the options available. We'll probable dive deeper into the why of this over the course of the project.

Some insights from user research -

- Since the app actually is use case specific, it is used almost equally by all genders (sampling bias again may apply)

- Husband-wife combos use app separately, mainly because they have individual uses and no family plan available.

- No real alternatives are used or even tried.

All of the users have rated Splitwise highly, no real complaints. Content with the free & ad-filled app.

- Heavy usage within cities. This could also be affected by sampling bias but intuition suggests this may have low penetration in tier 2 locations due to a lack of language support.

Ideal Customer Profile

Madhav

Madhav is a 25 year old engineer who is now living in Bangalore having moved from Hyderabad for work. He works at Swiggy and is staying with two of his college friends in an apartment in Kormangala, Bangalore. He works in a hybrid environment and so has to go to work two times a week. Madhav has a cook and a maid for his house and has been trying to keep healthy by eating mostly home cooked food and working out. Staying with his college friends has its benefits - every weekend ends up being a social event where all of the roommates' friends show up. Madhav usually is the one handling the household so ends up paying for stuff everywhere.

Usual Expenses (in Rs.) -

- Rent - 10000 (total 30000)

- Cook and maid - 3000 (total 9000)

- Untagged expenses - 45000

Goals -

- Start saving for the future and the rainy day.

- He also wants to track household expenses so everyone rightly pays their share.

- Save enough for group trips.

Pain Points -

- Is usually always broke because he ends up paying for a lot of the stuff initially and then doesn't know how to split between his friends.

- Track his monthly group expenses.

Chaitra

Chaitra is 34 years old and is a consultant at PWC, Mumbai. She's married and lives with her husband. She and her husband have usually have long days at work on the weekdays and like to spend time socially on weekends with their common friend circle. Chaitra also has her own college group that she occasionally spends time with, even goes on trips. Chaitra's limited weekend outings are usually at fine dine restaurants so that she gets to enjoy the best food/drinks. She and her husband make sure that they are able to have weekend getaways with their friends at least once in three months.

Usual expenses -

- Household - 50000

- F&B - 30000

- Travel - 30000

Goals -

- Manage financial resources for family events.

- Build emergency family fund pool with relatives.

Pain points -

- Hard to track spends in group events.

- Needs to keep reminding family to pool in monthly for the family fund.

Let's see what a sample set of users say -

Question | Madhav | Chaitra | Rajveer | Murari | Amita |

|---|---|---|---|---|---|

Age Bracket | 23 | 34 | 28 | 34 | 33 |

What do you do for work? | Engineering | Consulting | Engineering | Product | Consulting |

Total monthly spends (in Rupees) | 60000 | 150000 | 100000 | 100000 | 100000 |

When did you first use Splitwise? | 2020 | 2014 | 2015 | 2016 | 2015 |

Where do you use Splitwise the most? | Between friends/roomates for everyday expenses | On group trips | Between housemates | Use Splitwise on a daily basis for all personal expenses | On group trips |

Best feature on Splitwise | Add/review/track expenses in one place | Split complicated group expenses, Simplify Debts | Simplify Debts | Overall expense tracking - individually and in groups. I know how much I need to pay someone individually and group wise | Simplify Debts |

Do you use Splitwise alternatives? | None | None | Google Sheets with my own format | None | None |

Do you use the Free or Paid version of Splitwise? | Paid | Free | Free | Free | Free |

What feature of Splitwise would you improve on? | Being able to clear debts on app | Use Splitwise like a vault during trips. It'd be ideal if Splitwise could act like a bank that everyone could pay before going on a trip. Helps with major expenses | Nothing specific | Nothing specific | Nothing specific |

What would you rate Splitwise on a scale of 1-5 | 5 | 5 | 5 | 5 | 5 |

Do you remember how you first used Splitwise? | On a group trip | On a group trip | On a group trip | On a group trip | On a group trip |

ICP Prioritisation | Madhav | Chaitra | Rajveer | Murari | Amita |

Adoption Curve | High | Medium | High | High | Medium |

Frequency of Use | High | Low | High | High | Low |

Apetite to Pay | Medium | Low | Low | Low | Low |

TAM | High | Medium | High | High | Medium |

Distribution Potential | High | Medium | Medium | Low | Medium |

Basis the ICP insights and prioritisation, we can narrow down the ICPs to three major categories

- ICP 1 (Madhav) - A power user. Uses most of the features on Splitwise and requires a Pro version to operate. Splitwise is a daily driver for this user.

- ICP 2 (Murari, Rajveer) - A core user. Uses as many features as available in the free version. Will continue to tolerate the ads in the free version through limited usage weekly.

- ICP 3 (Chaitra, Amita) - Occasional user. Since the usage of Splitwise is only on group trips, this type of user is happy to see their spends/balances on the app at the end of the trip and close out that trips' expenses.

C. How does the market look like?

Splitwise has been in existence since 2011 and in India since 2014. While it has a sizeable following among its user base, there have been a lot of tiny competitors in India that have't managed to really scale. In the international market there have been a few that have provided competition to Splitwise (Tricount, Splid).

In India, Splitwise rules the roost. A theory on its dominance could be that since the use case is so specific and the adoption is so high, unless there's an app that is much better (at something Splitwise is great at) at Splitting bills and is free to use, no one will switch. This makes the entry barrier high for new apps to exist in the Indian market, especially since it is a primarily free usage market rather than a paid usage one (based on user surveys).

D. TAM, SAM, & SOM

Let's first write down some steps in place for solving for TAM, SAM, and SOM.

TAM is the Total Addressable Market. We simply would look at the Average Revenue per User and multiply it by the total number of users available. Since Splitwise is a fintech company, we'd look at its TAM as a fintech.

We would look at the number of 18-35 year olds in India - the age bracket that predominantly use Splitwise. According to the cencus 2011, India would have 336 million or 33.6 crores of people between the age of 15-35. If we can adjust that for between 18-35 this number would revise to 28.8 crores.

Number of 18-35 year olds - 28.8 crores

% of smartphone penetration - 40% in 2023 (refer Resources)

Total smartphone users between 18-35 - 11.5 crores

Of this, only 35% of users are urban population. So, the revised smartphone users in urban population - 4 crores.

ARPU of Splitwise - Rs. 1500 per year.

TAM = 1500 * 4,00,00,000 = Rs. 6000 Crores.

SAM is the Serviceable Addressable Market, essentially meaning the actual part of the unrealistic TAM that Splitwise can look at as a target considering the current app & its user base demographics.

Since we have an urban population of 4 crores in cities, let's look at how my of these would be Splitwise customers. By looking at our users, whether college students or working professionals, we've observed that people who use Splitwise mostly use it when their spends are high and complex to track. By a broad assumption, we can assume that they spend upwards of Rs. 2L/year on expenses - which is why Splitwise helps. This puts them at a family earning of greater than at least Rs. 5L/year.

According to the cencus, in 2023, 27% of Indians earn above Rs. 5L. If we convert the same metric to the number we have, we get 1.08Cr population that actually have the need for Splitwise.

If we now look try to calculate our SAM -

SAM = 1500 * 4,00,00,000 * 27% = Rs. 1620 Crores.

SOM is the Serviceable Obtainable Market which is the actual amount of people being served by Splitwise with its current offerings. For estimates, Splitwise's global revenue is rumoured to be between $120-150m global that is roughly Rs. 2000Cr in a paying market (monthly billing of $5 per user against $2 in India). Out of user research, only 1 out of 20 users used a paid account. This ratio could be higher in a larger dataset. However, let us consider these figures while we try to calculate SOM.

How do we look at the most realistic revenue figure that Splitwise can target for their current FY.

% of users opting for a paid account (user research) - 1/20 or 5%.

% of users using the free account - 95%.

Revenue per year for the paid account holders - Rs. 1500/year

Revenue generated for the free account holders - Rs. 150/year (through ads, approximated based on standard free v/s paid stats)

Weighted average ARPU per year - Rs. 217.5

Considering Splitwise has near 100% market share in the bill splitting market, we would see no dilution to competition.

However, Splitwise penetration within the urban populace needs to be estimated. Let's say Splitwise has reached 40-50% of the urban populace (possible due to the exponential nature of the application, covered more under acquisition channels)

Total available users = 40% * 1.08Cr = .43Cr

SOM = 217.5 * .43 = Between Rs. 90Cr to Rs. 110Cr

Acquisition Channels

Before we dwell on individual channels, lets look at a brief on each channel and how it may work for Splitwise. We broadly have -

- Paid Ads - An interesting channel for Splitwise. This works if the LTV of the user is at least 5x the CAC so the company can realise the revenue generated by the user over a prolonged period. Key aspects to consider here are the weighted average revenue per user per year while considering the LTV.

- Search - This will be one of the top acquisition channels for Splitwise primarily because of the intent behind search. A user who has a need will search for this and Splitwise will need to rank the among the best here. Again, since the use case is specific - Splitting Bills - a user will have very high intent when searching.

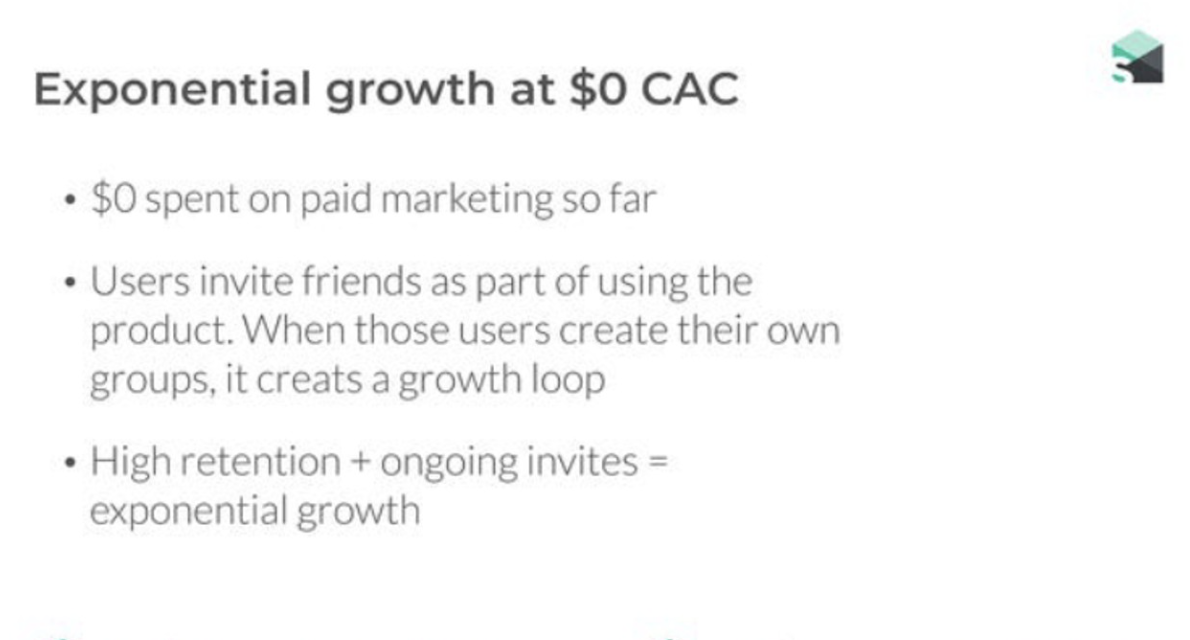

- Referral - By far, the biggest acquisition channel for Splitwise. This has exponential growth possibilities because of the use case of Splitwise - splitting bills with friends. When you split bills, you add your friends to Splitwise and they use the app.

- Product Integrations - Since Splitwise does not have the option of payments in India, this can be a profitable channel for integrations.

- Content Loops - For Splitwise, since the use case is specific - read functional - content loops will simply be educational and not a viable acquisition channel.

First let's look at 3 important slides from Splitwise's pitch deck in 2021 when they raised $20m.

Clearly, since the network effects of referring your friends is so high, they pay nothing to social media to attract customers, i.e, CAC = 0. This may not be entirely true since Splitwise will pay to acquire every first friend who then exponentially helps spread the word through referrals. That said, let us take a individual look at each channel nevertheless.

Paid Ads

Because of the potential of network effects, if Splitwise spends money on a user to acquire them, this user will easily add their group of friends who will use the app and they will add their other friends and so on. The key is acquiring the first new user to Splitwise who can multiply this.

It would make sense for Splitwise to pay to acquire this first friend. Especially targeting new cohorts or young users (age bracket of 18, just rented a flat etc.) to acquire. If we look at a LTV (5 years, conservatively, Rs. 217*5 =~Rs.1100) of a user, since the potential of a new user in a cohort is so high, it is viable for Splitwise to explore acquiring a user with even CAC equaling LTV since one customer's acquisition cost will pay at least 4-5 friends' LTV.

Splitwise can budget an acquisition cost of Rs. 1100 per user to acquire to be really aggressive in this segment and increase market presence. Below is a recent social media ad redirect graph for Splitwise, so it seems like they have started social media spends.

Search

Since every new user will search, either on web or app stores, for Splitwise or related search terms, Splitwise will need to consistently rank among the top here in order to maintain its position in the market. When a first time user searches for related use case to Splitwise, Splitwise will need to ensure that all related search options point to Splitwise at or near the top.

Take a look at the graphs below before we look deeper -

Splitwise ensures that it is best placed and is in the best position in the highest searched words/phrases for splitting bills.

Referrals

Just take a look at the graph above - Splitwise's highest acquisition of users go directly to Splitwise. This has been said enough but when one user helps sign on their cohort of users as a first time user, this new cohort will then help sign on the next cohort. This is zero spends to acquire a customer mainly due to the nature of the application itself - Splitwise is used to split bill with friends, so the friends will need to be on the application. In a way similar to a social media application.

Splitwise will pay a small amount of money to search or paid media to get one customer, then hook the customer on for repeat transactions and have them keep adding new users for their lifetime.

Product Integrations

For some strange reason, Splitwise hasn't reasonably leveraged this in the Indian market. Granted, there was an integration with Paytm in 2021 but this was only Android and never took off across applications.

Some examples below -

- Paytm - Have users pay directly from Splitwise through Paytm. This not only generates extra revenue for Splitwise, it also blocks off other payment apps from adding 'Splitting Bill' features - which Gpay and PhonePe have recently done.

- Bookmyshow, Makemytrip, Zomato - In all these cases, everytime a user books a ticket or pays a bill, having Splitwise have product integrations within these apps means the bill can directly be exported to Splitwise and will reflect on the expenses + will add users who may not be on the app.

Content Loops

Video - This is an education exercise for Splitwise and has no real ability to generate any acquisition. When you look at Splitwise's own YT channel, they have 5 total videos detailing how to use the app.

Text - By having articles on bill splitting and backlinking to Splitwise (under the sub-category of search channel), Splitwise has potential to acquire users going through informational or educational content reads. Screenshot below detailing the channel. This again is a very small portion of their user acquisition is mostly to augment their search acquisition channel.

The end.

Resources -

Splitwise Pitch Deck 2021 - https://www.linkedin.com/posts/ajay-shinde-414a62195_splitwise-pitch-deck-activity-7199041100093804548-xT2y

India Cencus 2011 - https://www.researchgate.net/publication/329782820_Role_of_Education_and_Skill_Development_to_Promote_Employment_in_India#pf3

India's smartphone penetration - https://www.morganstanley.com/ideas/india-smartphone-market-growth

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.